It’s significance is a matter of opinion, open to debate.

By Charlie Lamdin

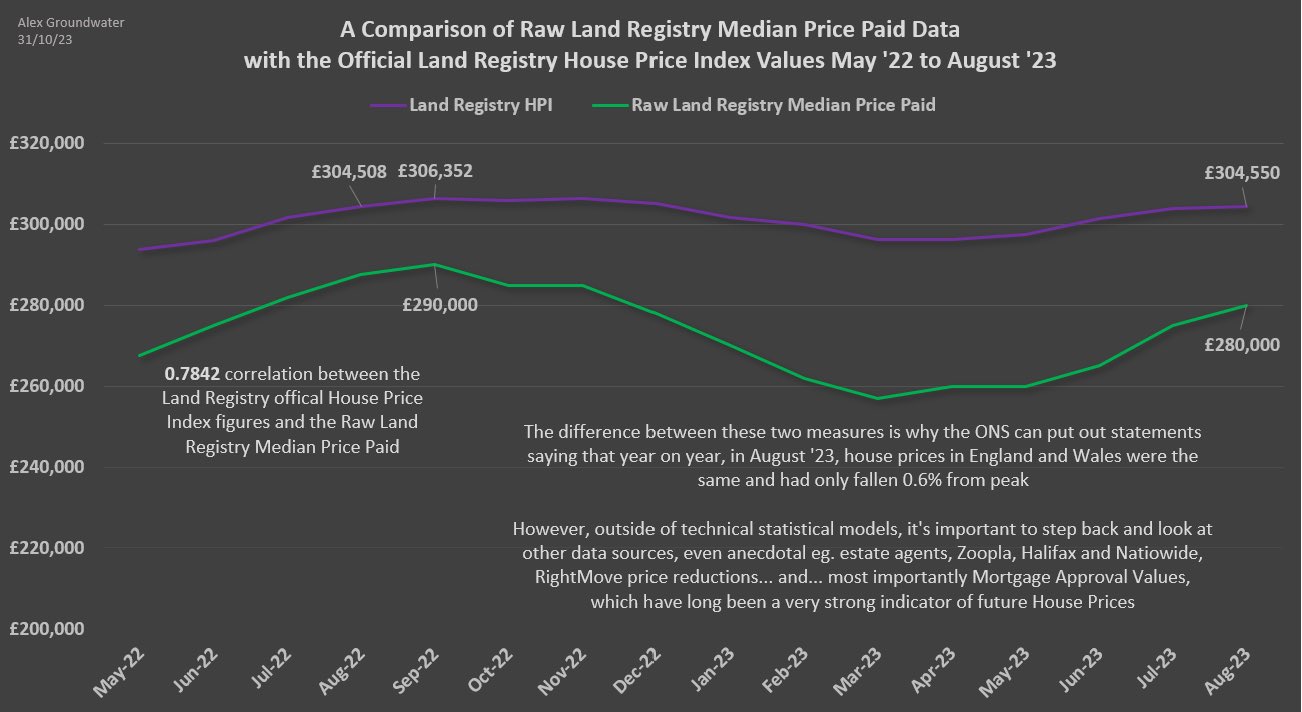

The existence of a discrepancy between the Land Registry’s House Price Index figures, and the raw (unweighted, unmanipulated) median figures is a verifiable fact illustrated nicely by @alexgroundwater ‘s graph.

You can check the raw data for yourself here: https://landregistry.data.gov.uk/app/ppd/

The discrepancy is useful to illustrate that indices which use the “Hedonic Regression Model” to calculate figures (such as Nationwide and Land Reg indices) are not always as stable, or do not always correlate as closely with what’s happening with what home movers think of as “house prices”. https://en.wikipedia.org/wiki/Hedonic_regression…

Nationwide have published a detailed explanation of their method here. It’s not a fun read, but it is helpful to understand that it is full of variables that they do not disclose, such as sample size and weighting changes. https://nationwide.co.uk/-/assets/nationwidecouk/documents/about/house-price-index/nationwide-hpi-methodology.pdf?rev=eb1695a5f9df46fa815b5810371c4785…

It’s complicated and confusing to say the least.

Opinion worthy of debate.

What is a matter of opinion and worthy of debate is the significance of the discrepancy. It’s important because in times of housing market uncertainty, instability and atypical behaviour, these indices become far more “skewed” and can have the unintentional effect of concealing what is really happening. For people making a home purchase or home moving decision, it’s therefore essential to understand, as best as possible, what’s really happening, and acknowledge the inherent weaknesses of standard indices during periods of market turbulence.

At this point in time, the conditions exist for biased parties in the moving industry to abuse the discrepancy and cite Nationwide and the Land Registry indices as “proof” that house prices aren’t falling. It is simply not the case that the indices prove house prices are doing anything, one way or the other.

Challenge questionable claims

So, if you hear anyone, an agent, a mortgage broker or especially someone trying to make you invest in property, saying “house prices aren’t falling because Land Reg and Nationwide say so” you can contest this claim, and point them to this post.

Hedonic regression has the effect of “squashing the humps and bumps” of the raw data, and this can be useful. But as you can see from the graph, it is also the case, for what reason we don’t know, that the indices understate price falls more than they understate price increases.

As Richard Donnell the Director of Research at Zoopla said, it is the trend that is more important than any single month of results, from an index.

Watch the video of the late night (with wine!) discussion Alex Groundwater and I had on the topic, with more detail. https://youtube.com/live/NqeLDZ9czk4