Charlie Lamdin answers a journalist’s questions.

Q: Do you know of certain estate agents who over-value properties?

Yes, most agents are reluctantly forced into over-valuing, because of the worst-offending, large agents who do it to extremes. London’s two largest agents are among the worst offenders, evidenced by the number of properties they never sell. Hint: “Dextons”

According to data from TwentyEA they each sell less than 30% of the properties they list, but the other 70% are unable to change agents because of the onerous long, exclusive sole-agency contract they sign, often without realising they have done so.

When sellers hear these excessive ‘values’ from more than one agent, they are easily seduced into believing their home is worth far more than it really is. Overvaluing by 15-20% is common for the worst offending agents, even though it’s explicitly banned by The Property Ombudsman.

Here’s an example case study of a formal complaint being upheld in a case where the agent overvalued by more than 20%.

The problem for honest agents

The problem for honest agents is that over-optimistic sellers never want to hear honest valuations, and so those honest agents lose business. This is made worse by misleading house price index reports from Rightmove, whose ‘average price’ is £100,000 more than, for example, Zoopla’s average price, because Rightmove’s is based on ‘asking prices’ of properties that never sell.

Q: When you value a property, what research do you do before visiting?

All agents should be researching the most recent exchange prices of comparable properties, using individual case studies to show why some similar properties fetch higher prices than others. It’s impossible to accurately value any property, because the amount it may finally sell for can vary widely up or down based on factors which aren’t necessarily obvious.

For example, problem neighbours (perhaps with rotting cars on their driveway for example) is a firm factor in why a property won’t sell, but comparable research won’t show that. Research on comparable properties also won’t reflect other invisible problems such as bad smells, which can severely affect a properties sale price, and which is difficult for an agent to point out to the seller for risk of offending them.

But, research before valuing a property should explicitly exclude asking prices of unsold properties. Only properties showing as “under offer” or “sold subject to contract” may be considered, but many of these sales will fall through so even they are of limited value.

Q: Do you use any tech to help with your valuation?

There are various datasets available to various industry professionals (for example, registered valuers visiting a property on behalf of a lender) but these are, at best, vague indicators intended to guide, but not provide individual valuations.

Price per square foot?

Q: Do you price per square foot?

Price per square foot does happen in London and is helpful, but not definitive. It’s used less outside London, but may increase. The problem is that unless a house has been measured by a qualified surveyor, or using the RICS Code of Measuring Practice, the square footage measurements can be significantly inaccurate, and lead to liability for any agent selling on a price per square foot basis.

Q: What’s the percentage price difference between a well-presented property and one that needs cosmetic work?

That’s a piece-of-string question unfortunately. There are never any reliable percentages for this, especially as almost every cosmetic-update job ends up being much more than cosmetic! But, a structurally sound but decoratively tired home compared with a newly cosmetically refurbished home would typically be anywhere from 5% to 15% difference. Again, individual specifics will vary this

Q: Had any specific case studies when your valuations have been spot on or totally out?

Yes and yes. Very good agents will often get the value right within a couple of percent, but equally, even the best agents can be wrong, in both directions.

Is valuing home art or science?

Q: Is property valuation an art or a science? And why?

FIrstly, it’s important to point out that Estate Agents are expressly forbidden from providing ‘valuations’. Only qualified surveyors can do that. The reason the term is used is because the only question sellers ever ask is “what’s my home worth?” which is the wrong question to ask, for the following reason.

The only way to find out precisely what any individual home is worth at any specific time, is to have competing, funded buyers making bids. There is no other way. No one, not even qualified valuers, know what a property will sell for.

If you only get one offer, you have almost certainly sold for less than you could have sold it with competing buyers. That may not matter to you if you are selling to buy and you’ve achieved a sufficient price, but an agent who doesn’t get you competing bids has not done their job properly.

Seller readiness affects price

Q: Anything else worth noting?

Yes. One of the things that impacts interest levels, and therefore bid numbers and final price, is how ready sellers are to sell. Sellers who bring their home to the market “contract ready”, meaning they have already selected a conveyancer and had all the sale paperwork prepared, will attract more buyers because the sale will be faster. Things like this are never factored into ‘valuations’.

When an agent comes around to talk to you about selling your house, it’s never in fact a ‘valuation’. It’s a marketing advice meeting where they tell you the number they think you want to hear. If the worst over valuers stopped over-valuing so badly, property sales would happen faster, moving home would be easier, social mobility would improve.

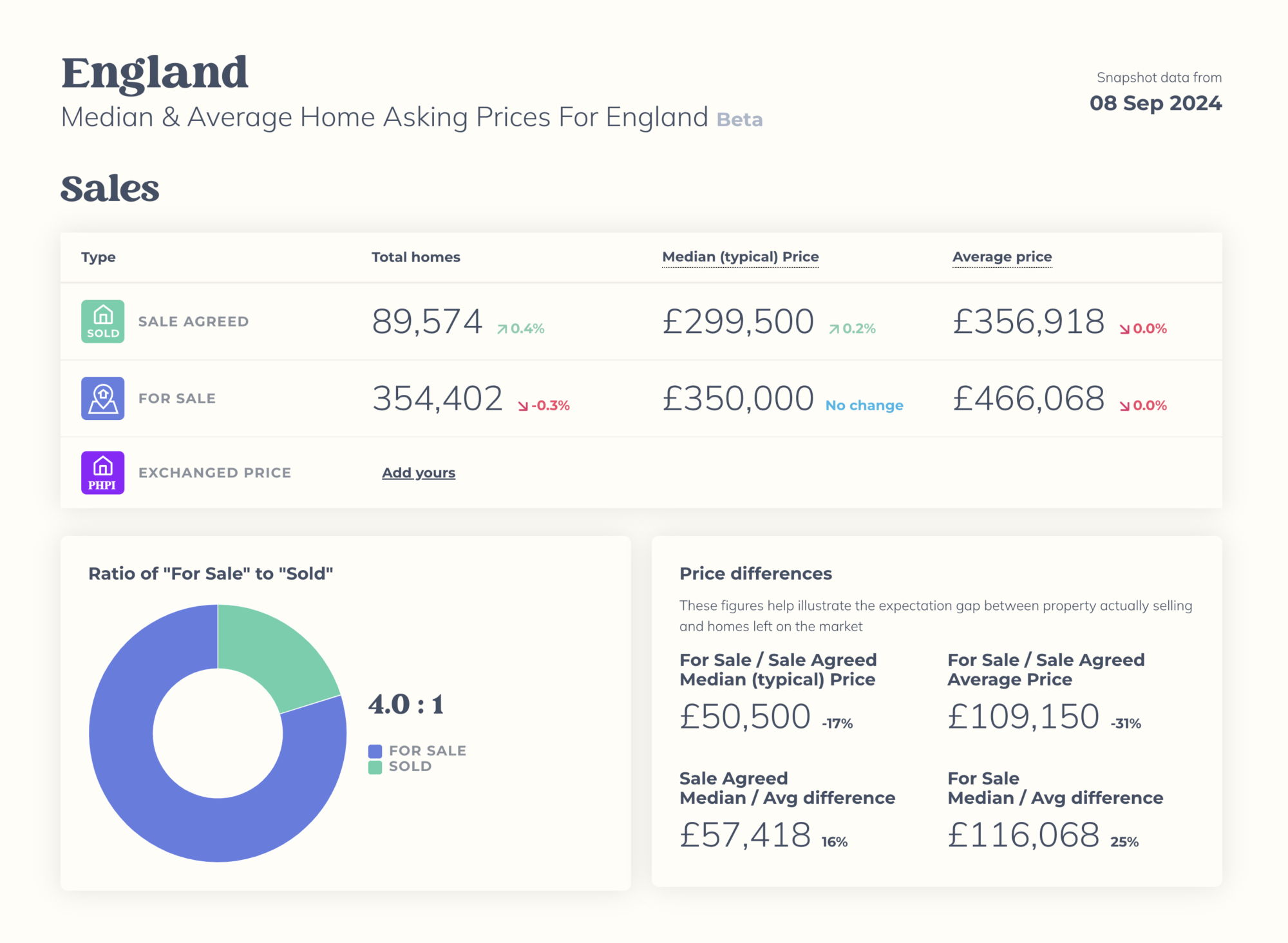

Which is why we’re launching the BestAgent House Price Index, which is more thorough and comprehensive already with the index prices are separated into For Sale (ie not sold) and Sale Agreed averages. You can see that there’s a £110,000 difference between the Average “Unsold” and “Sold” price, and also that the average is misleadingly high. The “Median” is much closer to typical prices (and is the metric used in America for House Prices). This still shows a £50,000 difference between the asking prices of homes showing as “sold” and “For Sale”.

Given that these figures are for the whole of the market (unlike Halifax, Nationwide or even Rightmove) it’s also a much larger sample size, giving a fairer representation of what’s happening.

No one knows.

No one knows what an individual house will sell for. It’s always guesswork with varying degrees of success on the outcome.

The golden question sellers should ask all agents is:

“We know that the sale price of our house will be determined by the market. Our question is, what’s your process to ensure we get funded, competing bidders within a realistic time frame?”. They should choose the agent who has the most thorough, credible and detailed answer to that question. If you choose an agent based on asking price and low fee, you’re almost guaranteed a poor outcome.

If an agent wants you to sign a 6 month sole agency agreement, they’re saying that’s how long they need to sell your home. Never, ever sign a long sole agency agreement.